Are you looking to improve your investing skills? Want a better understanding of the stock market? Look no further than these top six stock market books. For any experience level, these books give insights and strategies to help you succeed in the stock market. In this article, you’ll see why each of these books made the list.

Investing in the stock market can be a daunting task. That’s especially true for beginners. With so many investment strategies to choose from, it’s easy to feel overwhelmed. However, by reading the right stock market books, you can learn about the markets and improve your investing.

Best Stock Market Books

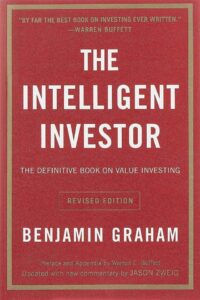

1. The Intelligent Investor

by Benjamin Graham

One of the best stock market books of all time, “The Intelligent Investor” is a must-read. It’s useful for anyone investing in the stock market. Written by Benjamin Graham, the father of value investing, this book is a guide to investing in companies. Graham’s principles of value investing are timeless. Warren Buffett and many other successful investors have used this investing book.

One of the key concepts in “The Intelligent Investor” is the idea of the “margin of safety.” This is the difference between the price of a stock and its intrinsic value. Graham argues that investors should look for stocks with a wide margin of safety. These stocks are less likely to result in losses. By following this approach, you can reduce risk and increase returns. Whether you’re just starting or well into investing, “The Intelligent Investor” is a great read. It hands you valuable insights and strategies to succeed in the stock market.

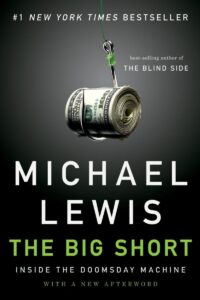

2. The Big Short: Inside the Doomsday Machine

by Michael Lewis

This stock market book tells the story of the 2008 financial crisis. It gives the perspective of investors who predicted and profited from the crisis. “The Big Short” is an exciting read with insight into the inner workings of the stock market. It highlights psychology and investing. Michael Lewis’ writing is enjoyable, and this makes it a great read. It’s a top choice among the sea of stock market books.

“The Big Short” is its portrayal of the characters during the crisis. It includes hedge fund managers who predicted the crisis and bankers who caused it. Lewis provides a close look at the events leading up to the crisis. By reading this book, you can gain a better understanding of the stock market. And ultimately, the people who drive it. You’ll also learn about critical thinking and going against the crowd. This is called contrarian investing.

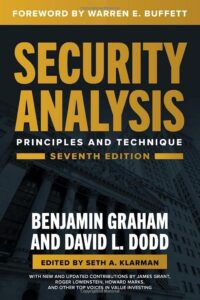

3. Security Analysis

by Benjamin Graham and David Dodd

This one’s a classic stock market book. “Security Analysis” is a guide to analyzing stocks and bonds. Written by Benjamin Graham and David Dodd, this book gives a framework for evaluating investments and making better decisions. This book is a must-read to improve investing skills and knowledge of the stock market.

One of the key concepts in “Security Analysis” is the idea of the intrinsic value of a stock. This refers to the true value of a stock. It’s based on its underlying financials of the business. Graham and Dodd argue that investors should always look for mispriced stocks. If the market price is higher than the intrinsic value, there’s value to unlock. These mispriced stocks are more likely to provide strong returns over the long term. By following this principle, investors can avoid costly mistakes.

4. One Up On Wall Street

by Peter Lynch

Peter Lynch’s “One Up On Wall Street” is one of the best stock market books. It gives insight into the mind of one of the most successful investors of all time. Lynch shares his strategies for finding and investing in companies. He gives guidance on how to avoid common pitfalls. This book is a great read to improve your investing skills. You can learn a lot from the world’s best investors.

“One Up On Wall Street” is Lynch’s discussion of the value of research and due diligence. He argues that investors should always do their own research. You should avoid relying on the opinions of others. There are lots of market pundits out there. By following this book, investors can make better decisions. Lynch also shows how to evaluate companies and find potential winners.

5. The Bogleheads’ Guide to Investing

This stock market book is a great guide. It covers topics such as asset allocation, diversification, and tax optimization. These topics might sound boring, but they’re vital to understand. Written by a team of investors, “The Bogleheads’ Guide to Investing” is a great resource.

One of the key concepts in “The Bogleheads’ Guide to Investing” is the idea of the “efficient market hypothesis.” This refers to the idea that the stock market is efficient and that it’s impossible to consistently beat the market. The authors argue that investors should therefore focus on low-cost index funds. Don’t try to pick individual winners. By following this principle, you can reduce costs and increase potential returns.

6. The Essays of Warren Buffett: Lessons for Corporate America

edited by Lawrence Cunningham

This collection of essays by Warren Buffett is a treasure trove. It’s packed with insights into the mind of one of the most successful investors. Buffett shares his thoughts on investing, business, and the stock market. It provides valuable lessons for anyone looking to improve their investing skills. This stock market book is a must-read.

“The Essays of Warren Buffett” covers a lot of ground and themes. One key topic is having a long-term perspective. He argues that investors should focus on the long term. You should avoid getting caught up in short-term market moves. With this approach, investors can reduce risk and stay invested in great companies. Buffett also gives insight on how to evaluate companies and pick which ones to invest in.

Why Read Stock Market Books?

So, why should you read stock market books? The answer is simple: by reading the right books, you can gain a deeper understanding of the stock market. With this knowledge, you can make better investment decisions. These investing books deliver insights and strategies to help you succeed in the stock market. They can also help you avoid costly mistakes and reduce your risk.

Reading stock market books can also help you develop a long-term view. It can help you play long-term trends. It’s generally best to avoid getting caught up in short-term market moves.

Overall, reading these books can be a great way to learn. You’ll uncover many insights from the minds of the world’s most successful investors. Feel free to click on each of the best stock market books above. You can read more about them and see reviews.