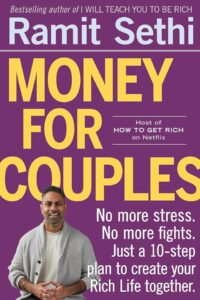

Ramit Sethi’s new book, Money for Couples, builds on the success of his bestselling I Will Teach You to Be Rich, offering a powerful guide aimed at transforming financial frustration into joy. As anyone in a relationship knows, money can often be a contentious issue, leading to stress and conflict. Sethi’s innovative approach equips couples with the tools they need to navigate their financial landscape without resorting to boring budgets or restrictive plans. Instead, he encourages readers to embrace the journey of building their “Rich Life” together.

In Money for Couples, Sethi tackles the most common financial issues that arise in relationships, presenting them in a relatable and engaging manner. The book is structured around key themes that resonate with couples, allowing readers to identify their unique challenges while providing practical solutions.

Stop Fighting Over Money

One of the first major insights Sethi offers is about the emotional underpinnings of financial disputes. Rather than framing discussions about money as merely mathematical or strategic, he delves into the feelings and fears that often fuel these arguments. Sethi encourages couples to understand that money conversations can be transformative rather than confrontational. By fostering an environment of open communication, couples can discuss their financial goals and anxieties without the fear of triggering a fight.

Sethi provides actionable techniques to facilitate these discussions, including guided questions and prompts that can help partners articulate their feelings around money. This approach not only mitigates conflict but also strengthens the emotional bond between partners. The result? A shared financial vision that unites rather than divides.

Get Both Partners to Participate in Finances

A significant barrier many couples face is the imbalance in financial participation. Often, one partner may take on the bulk of the financial responsibilities while the other remains disengaged. Sethi emphasizes the importance of involving both partners in financial decisions, and he offers strategies to achieve this. Through engaging exercises, he encourages couples to collaboratively set financial goals, track expenses, and celebrate milestones.

By democratizing the financial landscape within the relationship, both partners gain a sense of ownership and accountability. This mutual involvement fosters a sense of teamwork, transforming financial management from a chore into a shared adventure.

Reconcile Saver and Spender Dynamics

Every couple has a unique financial dynamic, and Sethi does an excellent job of addressing the common contrast between the Saver and the Spender. Rather than suggesting one partner needs to change their habits completely, he advocates for understanding and leveraging these differences to create a balanced financial strategy.

Ramit Sethi’s new book provides insights into how Savers can embrace spontaneity and how Spenders can appreciate the value of saving. He offers practical tools for both partners to create a spending plan that honors their individual styles while still promoting financial health. This balance not only reduces tension but also allows couples to enjoy their financial lives more fully.

Take Control of Your Debt with Ramit Sethi’s New Book

Debt can be a significant source of stress for couples, but Sethi reframes this challenge as an opportunity for growth. In Money for Couples, he outlines a clear and actionable plan for tackling debt together. He addresses the psychological aspects of debt—such as guilt and fear—while also providing concrete steps to reduce and manage it effectively.

By empowering couples to take control of their debt, Sethi encourages a mindset shift from one of defeat to one of resilience. His strategies are practical and realistic, making the process feel less daunting. With each step forward, couples can build confidence and trust in their financial capabilities.

Real-World Stories from Ramit Sethi’s New Book

What sets Money for Couples apart is Sethi’s use of real-world stories to illustrate his points. Each chapter is packed with anecdotes that bring the concepts to life, allowing readers to see themselves in the scenarios. These relatable examples highlight the challenges and triumphs of couples from various backgrounds, demonstrating that financial harmony is achievable for anyone.

Sethi’s storytelling ability not only makes the material engaging but also reinforces the idea that financial success is not just about numbers—it’s about people. Through these stories, readers gain a deeper understanding of the emotional journey couples undertake as they navigate their finances together.

A More Adventurous, Spontaneous, and Generous Life

Ultimately, Money for Couples is about more than just managing money; it’s about using finances as a tool to live a richer life. Sethi encourages couples to dream big, to plan adventures, and to embrace spontaneity—all while maintaining financial health. By reframing money as a means to enhance their relationship rather than a source of stress, couples can cultivate a lifestyle that is adventurous, spontaneous, and generous.

The book concludes with a powerful reminder that financial wellness is a journey, not a destination. Sethi’s optimistic and empowering tone leaves readers inspired to take action, to engage in meaningful conversations, and to build a financial future together.

Ramit Sethi’s New Book – Conclusion

In Ramit Sethi’s new book Money for Couples, Ramit Sethi provides an invaluable resource for couples looking to harmonize their financial lives. With practical advice, relatable stories, and a focus on emotional connection, this book is poised to become a go-to guide for any partnership seeking to navigate the complexities of money. As the release date approaches, readers can look forward to a transformative journey that promises to turn financial frustration into a fulfilling and joyous shared experience. With Sethi’s guidance, couples will not only manage their finances more effectively but also strengthen their relationship in the process.

Check Out Our Best Property Investment Books to Grow Your Wealth